Debt Payoff Calculator

Debt Payoff Calculator

Debt can quickly feel overwhelming — whether it’s from credit cards, student loans, personal loans, or auto loans. Managing multiple debts, each with different interest rates and monthly payments, makes it hard to track progress.

That’s where our Free Debt Payoff Calculator comes in. It’s a smart, easy-to-use online tool that helps you understand:

- How long it will take to become debt-free

- How much interest you’ll pay overall

- How extra payments can save you time and money

Whether you live in the United States, Canada, or anywhere worldwide — this calculator helps you take charge of your finances and plan your journey to financial freedom.

What Is a Debt Payoff Calculator?

A Debt Payoff Calculator is a financial planning tool designed to help you create a step-by-step strategy for paying off debt. It estimates:

- The debt-free date

- The total interest you’ll pay

- The effect of extra payments on your payoff time

This tool works for all kinds of debt, including:

- Credit card balances

- Auto loans

- Student loans

- Personal loans

- Debt consolidation loans

You can use it online or download it as a Debt Payoff Calculator Excel spreadsheet or a Google Sheets version — both free and customizable.

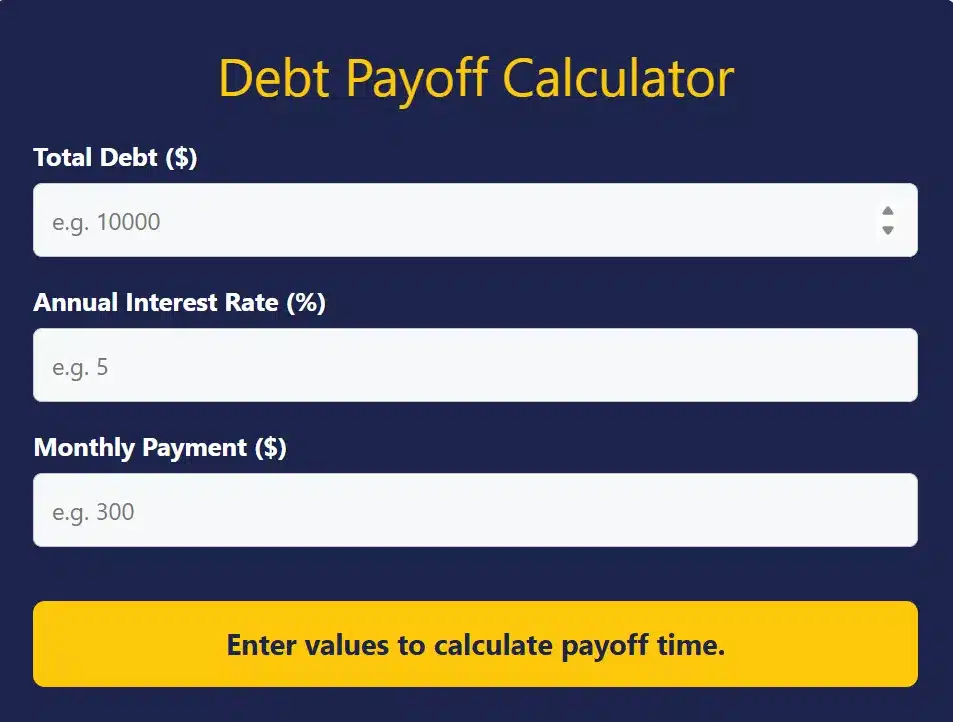

How to Use the Debt Payoff Calculator

Follow these steps to create your personalized debt elimination plan:

Step 1: List Your Debts

Write down all your debts and their details:

- Total balance

- Annual Percentage Rate (APR)

- Minimum monthly payment

- Any extra payment you can make

Step 2: Enter Your Data

Input all details into the calculator. You can add multiple debts, each with different balances and rates.

Step 3: Add Extra Payments (Optional)

If you can pay more than the minimum, enter that amount as an extra payment.

Step 4: Review Your Results

The calculator will show:

- Your estimated debt-free date

- The total interest you’ll pay

- How extra payments affect your timeline

- A monthly amortization schedule (breakdown of payments)

These insights give you a complete picture of your financial path and help you make confident, informed decisions.

Debt Payoff Methods: Snowball vs. Avalanche

When planning debt repayment, two popular strategies dominate: the Debt Snowball Method and the Debt Avalanche Method.

Debt Snowball Method

This approach focuses on paying off your smallest debts first, regardless of interest rate.

Once the smallest debt is paid off, you roll that payment into the next one — creating a “snowball” effect.

Benefits:

- Builds momentum and motivation

- Gives quick wins to stay committed

Example:

If you owe $500, $2,000, and $5,000:

- Pay off $500 first

- Then $2,000

- Then $5,000

Each victory keeps you motivated, and your payment power grows as each debt disappears.

Debt Avalanche Method

This strategy focuses on paying off debts with the highest interest rates first, saving you more money in the long run.

Benefits:

- Reduces total interest paid

- Pays off overall debt faster

Example:

If your credit card has a 20% APR and your auto loan has 10%, you’ll pay off the credit card first.

Verdict:

- Use Snowball for motivation and consistency.

- Use Avalanche for maximum savings and efficiency.

Our Debt Payoff Calculator allows you to compare both methods and choose what fits you best.

Why You Should Use a Debt Payoff Calculator

Here’s why experts (like Dave Ramsey and NerdWallet) recommend using a calculator before starting your debt payoff journey:

1. Clarity and Control

You’ll know exactly how much you owe, how long it’ll take, and how much you’ll save.

2. Strategic Planning

The calculator shows side-by-side comparisons between the Snowball and Avalanche methods.

3. Motivation to Stay Consistent

Seeing your progress visually helps you stay committed to your goal.

4. Optimize Your Payments

By testing different payment amounts, you can find the most efficient way to pay off debt faster.

5. Worldwide Compatibility

Whether in USD, CAD, or another currency, the tool adjusts perfectly for global users.

How Extra Payments Can Change Everything

Even small extra payments make a big difference.

For example:

| Example | Without Extra | With $50 Extra/Month |

| Balance | $5,000 | $5,000 |

| Interest Rate | 20% | 20% |

| Payoff Time | 4 years | 3 years |

| Interest Paid | $2,200 | $1,650 |

You save $550 in interest and become debt-free 12 months earlier.

That’s the power of using a Debt Payoff Calculator with Extra Payments — you can instantly see how small changes create massive results.

Debt Payoff Calculator for Excel, Google Sheets & Canada

Debt Payoff Calculator Excel

Download the Excel version to manually track payments, interest, and balances. Great for offline planning or budgeting spreadsheets.

Debt Payoff Calculator Google Sheets

Use our free Google Sheets version to manage and update your data from anywhere. Perfect for online accessibility and real-time tracking.

Debt Payoff Calculator Canada

Canadian users can use this version with CAD currency and Canadian-style interest rate formatting. Works seamlessly for Canadian credit cards and loans.

All versions are free, accurate, and secure — no registration required.

Debt Consolidation & Repayment Options

If your debts have high interest rates, consider these financial strategies:

1. Debt Consolidation Loans

Combine multiple debts into a single loan with a lower interest rate. Simplifies payments and saves interest.

2. Balance Transfer Credit Cards

Transfer your credit card debt to a 0% APR card (for 6–18 months). Helps you pay down balances faster without accruing interest.

3. Personal Loans

Pay off high-interest debts with a personal loan offering fixed rates and predictable payments.

4. Credit Counseling

Work with certified professionals who can negotiate better terms or lower rates with your creditors.

Combining these methods with a debt payoff calculator ensures you stay strategic and on track toward financial independence.

Related Tools:

Frequently Asked Questions (FAQs)

1. Can I use this calculator for all types of debt?

Yes! You can include credit cards, auto loans, student loans, and personal loans.

2. What’s the best debt payoff strategy — snowball or avalanche?

The snowball method is better for motivation, while the avalanche method is better for saving money.

3. Does this calculator show a debt-free date?

Yes — it gives you the exact month and year when you’ll become debt-free.

4. Can I add extra payments?

Absolutely! The calculator shows how even small extra payments affect your payoff timeline.

5. Does this calculator work in Canada?

Yes, our tool works globally. For Canadian users, enter your debts in CAD and your interest rates in local format.

6. Is this calculator free?

Yes — 100% free. No hidden fees, no signups, and no credit card required.